Tuesday, March 31, 2009

Ford says no to auto bailout

Pawnshops and iPods

Last year, while living in Tulsa my wife and I were broken into and my iPod was stolen. About three months ago, I received a letter from Tulsa PD that my iP od was identified. Pawn shops in Oklahoma have to register all items into a centralized database by serial number (if available); when my iPod's serial number was entered it triggerd a stolen item report to the Tulsa PD. We executed the various affidavits and designated a former student to recover the property. She had to go to court to get an order to recover the property and this is what she said about the process:

od was identified. Pawn shops in Oklahoma have to register all items into a centralized database by serial number (if available); when my iPod's serial number was entered it triggerd a stolen item report to the Tulsa PD. We executed the various affidavits and designated a former student to recover the property. She had to go to court to get an order to recover the property and this is what she said about the process:

1-201's Buyer in the Ordinary Course exclusion rule in action! Kudos to Sandy Cooper for braving the pawn shop and the courts to recover my iPod. I am curious what music, if any, is left after sixteen months....

Apparently Tulsa releases stolen property once a month. There were about 12 people there wanting to recover. The judge called each name individually…asked if they were there to pick up “x” (mostly GPS’s by the way), whether there was anyone there from “x” pawn shop or if the individual who pawned it was there (there wasn’t for anyone), then said she’d sign the order and to sit down. This took about 15 minutes. Then we were instructed to go to the hallway while we waited for our paperwork. That took about 5 minutes. Then off to the pawn shop (apparently Tulsa does it this way because there’s no room in their property room). The pawn shop, as you know, was in north Tulsa. It was pouring down rain that day so it “wasn’t very busy” (apparently pawn shops are local hangouts). The manager took my paperwork then went looking for it…this took about 30 minutes! I was worried that he had sold it since he kept saying he couldn’t find it. But, after enough searching he found it. It was all wrapped up in cellophane with a City of Tulsa sticker on it stating it was stolen property. He checked my ID and I was on my way. Apparently, if it was a gun that was stolen they have to verify that you can legally be in possession of a fire arm before they can release it.

Pretty much uneventful, but interesting nonetheless.

Update Sandy also noted that the pawn broker checked the serial number on the pleadings meticulously, which caused me to remember how we came across the serial number. We contacted Apple Inc. who had the serial number. Even though Apple was more than willing to give us the serial number, they were not willing to let us know who reregistered the iPod. I suppose I can imagine why Apple might not be willing to police its stolen merchandise.

Monday, March 30, 2009

Wagoner Steps Down and Obama Grants GM/Chrysler More Time

And so today I'm announcing that my administration will offer GM and Chrysler a limited additional period of time to work with creditors, unions, and other stakeholders to fundamentally restructure in a way that would justify an investment of additional taxpayer dollars. During this period they must produce plans that would give the American people confidence in their long-term prospects for success.

Obama's speech:

Sunday, March 29, 2009

Money for Madoff Victims?

While Picard has paid 12 claims thus far at the $500,000 limit, the potential for clawbacks and the clearly limited pool of assets will lead to disappointed expectations for investors. For now, most seem to be waiting to see how Picard will distribute the assets for the SIPC. Investor claims were due March 4, 2009, but claims will also be considered up to July 2, 2009 for customers. Undoubtedly, there is also more to come about the failure of the SEC to investigate Madoff's business as contributing to increasing losses. Updated claims information is available at the Madoff Trustee website.

For a short primer on the SIPC:

Saturday, March 28, 2009

Southpark's Theological View of the Economic Crisis

Trey Parker and Matt Stone have created a theological view of the economic crisis. Bravo!

Click here to watch SouthPark in a new window.

Marc (MLR)

Wednesday, March 25, 2009

Subscribe to the NYT Online? Another Fun Mixed Goods Case

Another lively case from the forthcoming ABA Sales Survey is Wall Street Network, Ltd. V. New York Times Co., 66 U.C.C. Rep. Serv. 2d. (West) 261 (Cal. Ct. Appeals 2008). The court considered a breach of contract claim arising out of an Internet marketing agreement between New York Times Co. (NYT) and Click2Boost, Inc. (C2B). Under the agreement, C2B was to solicit subscriptions to the New York Times by means of “pop up” advertisements on web sites. The pop up ads would ask the user for their zip code and, if suitable for home delivery of the newspaper, would prompt the user to subscribe. NYT agreed to pay C2B for each subscription. After NYT terminated the agreement two weeks early due to believed deficiencies in the subscription submissions, C2B’s assignee, Wall Street Network, Ltd., brought suit.

Another lively case from the forthcoming ABA Sales Survey is Wall Street Network, Ltd. V. New York Times Co., 66 U.C.C. Rep. Serv. 2d. (West) 261 (Cal. Ct. Appeals 2008). The court considered a breach of contract claim arising out of an Internet marketing agreement between New York Times Co. (NYT) and Click2Boost, Inc. (C2B). Under the agreement, C2B was to solicit subscriptions to the New York Times by means of “pop up” advertisements on web sites. The pop up ads would ask the user for their zip code and, if suitable for home delivery of the newspaper, would prompt the user to subscribe. NYT agreed to pay C2B for each subscription. After NYT terminated the agreement two weeks early due to believed deficiencies in the subscription submissions, C2B’s assignee, Wall Street Network, Ltd., brought suit.Was the subscription agreement governed by Article 2? The court ruled that the contract between NYT and C2B was not a sale of “goods” because the agreement was “for the placement of advertising.” Sure, the newspaper is a good, but that is not the determining fact. The newspaper as the good is more of a distraction here. What is really being sold? The court observed that even though C2B was paid a fee for each submission, C2B was not selling the names and addresses of the potential subscribers, but rather to place advertisements for the New York Times in designated locations and to forward to NYT the responses to the advertisements. Since advertising is not a good, Article 2 did not apply.

Tuesday, March 24, 2009

Signs of a Troubled Airline

I am on the road this week looking for houses in Southern California, and one thing struck me on the plane ride. U.S. Air sold advertising space to Zicam on its fold down tables -- ALL OF THEM. Little billboards under your drink as you fly. Is this just a smart allocation of space or signs of an Airline in trouble? Also slightly troubling, U.S. Air is now charging for WATER, soda, snacks, and of course spirits. I did not see a pay slot for the restroom but perhaps that innovation is not too far away. Are these things signs of desperation that might make you think twice about flying with that airline or is the airline efficiently using its assets.

Marc (MLR)

Monday, March 23, 2009

The Power of the Sequel: TARP II

Christine Hurt over at The Conglomerate recently gave a thumbs up to Race to Witch Mountain (See Family Fun Blogging: Race to Witch Mountain). And who doesn't like a good sequel? I've not seen it myself, but with three little kids in my house, it is sure to be in my future (from Christine's post, the movie may frighten the younger ones). Admittedly, I am old enough to remember the two original Witch Mountain films, so the nostalgia of the whole thing will get me to the theaters.

Christine Hurt over at The Conglomerate recently gave a thumbs up to Race to Witch Mountain (See Family Fun Blogging: Race to Witch Mountain). And who doesn't like a good sequel? I've not seen it myself, but with three little kids in my house, it is sure to be in my future (from Christine's post, the movie may frighten the younger ones). Admittedly, I am old enough to remember the two original Witch Mountain films, so the nostalgia of the whole thing will get me to the theaters.Others, including former Secretary of Treasury James Baker, are still urging that a non-sequel, original plan is needed here, in the form of a temporary bank nationalization (See Jason Kilborn's Banks Extending Crisis Pt. II). Surely, whether some of the troubled banks will be solid after removing toxic assets and whether management will make better decisions are debatable.

Larry Summers commented:

“We’re not managing to markets in the short run,” he said. “We don’t panic when markets go down and we don’t become euphoric when markets go up.”

If purchasing troubled assets is such a good idea, they why did the Bush administration abandon it? Why a sequel here? The success of TARP II will depend on pricing of the toxic assets. If the government doesn't offer enough sweeteners, the banks won't sell and buyers will not buy. And, why should they? Government handouts without accountability come now on a regular basis. Like Jason Kilborn, I find little to persuade me that banks are able to make the difficult sacrifices toward recovery. That is, these same banks that are in financial difficulty may prefer to hold onto these assets. Not that the banks believe the government will let them go into bankruptcy. If these banks don't think the government is offering them enough money to clean up their balance sheets, they won't do it. They don't believe they will go into bankruptcy, as we've all been convinced they are too big to fail. Instead, they may wait for yet better deals from the government. The banks may not yet believe that they need to take the hit to their financial statements.

I remember late last year the outrage over auto executives flying private jets to ask Congress for bailout monies. Congress' stern response to the auto industry seemed well placed. The message being, if you want government bailout monies then an element of frugality is in order. The current hullabaloo over the AIG bonus/retention payments (See Jim Chen's Best and the Brightest!) sends the clear message that some of the banks/executives have not yet gotten the frugality message.

My biggest concern with TARP II is simply that it will not succeed if the banks that need it haven't realized that we operate in a new marketplace. At least, David Trone, an analyst at Fox-Pitt Kelton Cochran Waller in New York, claims the private investors will now shun government programs as the bonus scandal has led to a “deep distrust” of the government and may cause a "massive brain drain" for those in the banking industry. Trone commented:

“Barring a miraculous reversal of this fear and distrust, we believe the toxic asset programs, as well as the existing TALF, will fail to reach the levels of activity necessary to unclog the system, heal the country’s financial system and improve credit availability . . . .”

Sunday, March 22, 2009

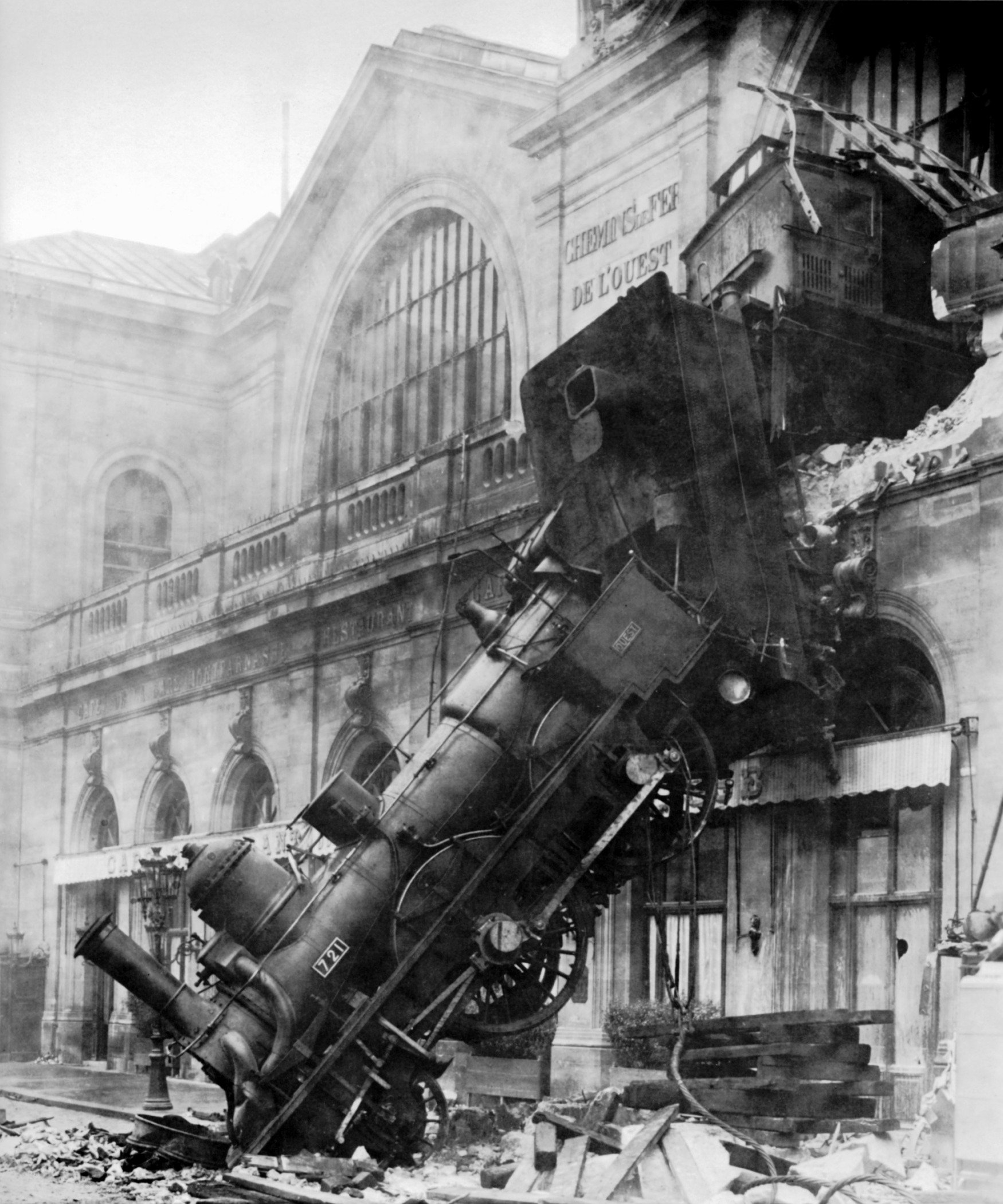

Train wreck

From Daphne Merkin, If Looks Could Steal, N.Y. Times (March 22, 2009):

Let's repeat that Platonic formula: “Everything that deceives can be said to enchant.” These are words worth remembering. Et encore, cette fois en français:[T]o call Mr. Madoff a sociopath isn’t really to explain him so much as to explain our failure to pick up on his scam. “Everything that deceives,” decreed Plato, “can be said to enchant.” Enter the sorcerer, the ganef, the man without qualities but with steady returns — and, I might add, a family man to the end. . . .

Enter us, the believers, the ones who signed on for the ride until it went off the rails, leaving wreckage as far as the eye could see.

Le Renard s'en saisit, et dit :"Mon bon Monsieur,

Apprenez que tout flatteur

Vit aux dépens de celui qui l'écoute:

Cette leçon vaut bien un fromage sans doute."

Friday, March 20, 2009

State Business Court Specialization

Today at lunch, between watching the 1st round NCAA games (Geaux Tigers), we were talking about specialized courts in various fields. For example, there is currently legislation, called the Patent Pilot Program (Senate Bill 299 and House Bill 628) to designate special district court judges as "patent judges." Under the bill, not less than $5,000,000 would be set aside to provide training to judges and staff, and for the hire of specialized law clerks to assist the new "patent judge." This discussion started me thinking about State Commercial Courts. I am wondering what the impact of State Commercial Courts are on decisions to arbitrate by clients. These business courts have been established to create a forum for specialized decision making by tribunals. For example, Maryland's Business and Technology Court Case Management Implementation committee provided for specialized training for judges in handling technology for easing the case burden on certain cases. New York's Commercial Division was created to "improve the efficiency with which such matters were addressed by the court and, at the same time, to enhance the quality of judicial treatment of those cases." Likewise, the North Carolina Business court was specifically created to oversee specialized complex commercial litigation matters.

Today at lunch, between watching the 1st round NCAA games (Geaux Tigers), we were talking about specialized courts in various fields. For example, there is currently legislation, called the Patent Pilot Program (Senate Bill 299 and House Bill 628) to designate special district court judges as "patent judges." Under the bill, not less than $5,000,000 would be set aside to provide training to judges and staff, and for the hire of specialized law clerks to assist the new "patent judge." This discussion started me thinking about State Commercial Courts. I am wondering what the impact of State Commercial Courts are on decisions to arbitrate by clients. These business courts have been established to create a forum for specialized decision making by tribunals. For example, Maryland's Business and Technology Court Case Management Implementation committee provided for specialized training for judges in handling technology for easing the case burden on certain cases. New York's Commercial Division was created to "improve the efficiency with which such matters were addressed by the court and, at the same time, to enhance the quality of judicial treatment of those cases." Likewise, the North Carolina Business court was specifically created to oversee specialized complex commercial litigation matters.

There are currently sixteen states that have either ventured to create specialized forums for commercial litigation or have entertained the idea in some form. It seems that most of these courts are designed around the complex nature of the litigation, rather than the subject matter; specifically the expertise seems to be handling document intensive litigation. So is business court or commercial court division a misnomer? Do litigants expect that Judges hearing these matters have a greater expertise than an ordinary judge in accounting principles or transactional work. If there is a higher level of expertise in transactional matters, does that have a trickle down impact on negotiating to arbitrate disputes by the parties -- (there may be other reasons for preferring arbitration, like not wanting to risk the resolution of disputes on a jury trial, but putting that aside, does the creation of a specialized forum for business problems alter parties dispute resolution choices?). Do these courts have actual technical commercial expertise, or are they just better at handling document intensive litigations than their district court counterparts. I am curious to hear from anyone that has experience with these courts.

Marc (MLR)

Thursday, March 19, 2009

Banks Extending the Crisis pt. II

Photo by rjones0856

Photo by rjones0856Someone needs to send these bankers to the principal's office and not let them out for recess any more--or perhaps expel them altogether. First the AIG bonus scandal, now we hear (yet again) that banks are deepening and extending the current crisis, despite Herculian federal efforts to pump them up with liquidity to solve the problem. Banks and their overly finicky underwriters are now making it difficult for even the most creditworthy borrowers to get loans. If the theory behind the stimulus moves is prop up the housing market by pumping liquidity into the mortgage finance market through the banks, it isn't working.

Tell me again why nationalizing these banks would be a bad idea . . . Does anyone reasonably believe that the feds would do a worse job of managing lending???

Wednesday, March 18, 2009

Ben Bernanke on 60 Minutes

Part I:

Watch CBS Videos Online

Part II:

Watch CBS Videos Online

Bernanke said the key to success is confidence. He thinks progress is being made in the area and that confidence will come in time leading to recovery. One early sign of recovery Bernanke is looking for is a large bank raising private equity. Not there yet. Bernanke's final words:

“I just have every confidence that as we get through this crisis, that our economy will begin to grow again, and it will remain -- the most powerful and dynamic economy in the world.”Not a lot of substance to the interview, but the whole idea of interviewing the Federal Reserve Chairman is unprecedented. That said, a good interview by Pelley and worth the time to watch.

Jon Stewart v. Jim Cramer

First, the background of the sparring before Jim Cramer's appearance on Comedy Central:

Second, the comedy central appearance. This full show is available at over at The Daily Show. Here are some of the highlights:

The business media should be held to a higher standard of reporting due to its ability to influence financial decision-making. Again, this is not a game. Tough night for Jim Cramer.

The Death of [the] Contracts [Course]... Maybe that's a good thing

The AALS Contracts list-serve two months ago carried a stream of interesting comments around the question whether contracts should be taught in four or six hour blocks of time. These discussions have been brought by the need to inject other things into the first year curriculum, such as skills courses, constitutional law, etc... (which I am all for). However, I want to offer a different proposal than a mere reduction of hours -- maybe we shouldn't teach contracts to first year students at all. Instead perhaps we should teach students in the first semester Article 2 of sales. Here are my reasons, in no particular order of significance. By the way, you can disparage me in person if you are going to the Contracts Panel at SEALS this summer, as this will be the basics of my presentation...

1. Its a Legislative World and I'm a Legislative.... The same argument I consistently hear justifying common law contracts as a First Year Course is that it teaches students how to read cases. First, doesn't Torts, Property, Criminal Law, and Civil Procedure do equally fine jobs of teaching students how to read cases? Second, and more importantly, where in the first year curriculum are we teaching students how to read statutes and Codes. We are not, and as a result, when students come to take a code based course, they repeat their first year growing pains again by by having to learn how to read and analyze statutes. Sales provides a great opportunity to fill the legislative gap and still .....

2. Introduce Students to the basic principles of contracting. Offer, assent, parole evidence, statute of frauds, battle of the forms (of course) impossibility, remedies... Its all there. The difference is two fold: one, the material is in a more concrete format in the form of a code; and two, the material becomes more understandable because students have a familiar and definite context for understanding specific rules like parole evidence, statute of frauds exceptions and the battle of the forms. As I tell my UCC students, we have all bought candy bars by the time we get to law school and we know the essence of the process --I give you money and you give me a Snickers. We now are putting definite terms to that process.

3. Is Common Law Contracts that relevant anymore? Sure the basic principles of offer, acceptance, etc.... in some form stretch the gambit of contracting. But our legal system has created so many different types of contracts that each vary in nuanced ways from each other. Employment contracts are different from sales contracts which are different than construction contracts, which are different from licenses and so on and so on. The idea that we are teaching general principles that stretch through the curriculum falls apart when students learn that each of these different contracts have their own unique language and terminology that renders the common law of contracts at best a quaint introduction to the sport of creating obligations. Add to that fact that much of contracting gets reduced to form-negotiations and contracting as an art becomes mostly irrelevant. If contracting were taught as an exercise in transacting, I believe it would be far more effective. One of the comments from the contracts list-serve discussion that I really appreciated came from Peter Linzer, in which he said:

At a less abstract, but much more practical level, I have for a long time been advocating a shift from Contracts as a course in busted deals to a course in what real contracts lawyers do, advising clients, helping them to plan, and getting the plan on paper through good drafting. I’m still trying to slip a bit of that into my four-credit course, but I can’t really change much. Some parts of Contracts must be taught from the cases (interpretation, the parol evidence rule, remedies, the click-wrap issues (which, of course, are also part of the transactional part of the process)). But the real task of preparing students to be transactional lawyers needs to be taught differently, and can’t be covered well in a four credit course. I can teach a class of 100 how to draft, but I can’t review their work to raise them beyond the very basics. That has to be covered in a more advanced course. But if we can sensitize students to what contract lawyers really do, and the important role of drafting and planning, we can greatly improve the abysmally low level of quality among most business lawyers, especially those dealing with small businesses. That, however, needs much more time than is available in a four hour course.

I concur.

4. Teaching common law contracts does not necessarily prepare students for the bar exam. First of all, students rarely retain what the parole evidence rule is versus the statute of frauds between the end of their contracts course and the beginning of their second year (or they may just deny any knowledge of those things in class). Moreover, we have pretty well ceded bar preparation to Bar-Bri, Mishmash, or what ever other cram course students are willing to fork out $2500 to cram long-forgotten doctrines in their minds. Have we all of a sudden become less confident in bar-review's capacity to teach contract doctrine as well? It seems to me that most professors I talk to vehemently deny that they are teaching for the bar (which I do as well). So why would we teach a course on that basis.

5. For that matter, Sales does not prepare students for the bar exam either, but there is a trickle down effect. In the same way that contracts does not necessarily create a long-term knowledge of contracts doctrines, neither will Sales. Though, at least by teaching sales early, we open the door for other UCC courses to be more accessible to students. Students that take Article 9 or Article 3-4, are more likely to be prepared for courses like bankruptcy, debtor and creditor rights, taxation, and corporations. Getting students in the sales curriculum earlier rather than later aids that process.

6. Wouldn't we all be happier teaching a perspectives-esque upper level course on the theory of contracts. Really isn't that what we all really want to teach anyway. This to me is the best use of the contracts course and one that often gets pushed aside for lack of hours or because students are not quite ready to understand these nuances. This is the art of preparing lawyers: equipping them with the intellectual tools to make rational decisions regarding how contracting should be undertaken. Forcing students to struggle through Law and Economics views of contracting, moral theory of contracting, etc... before they truly understand the contracting process seems to me to be reversed. Students will learn more and professors will be happier with the result.

The only upside to the contracts course is it might make the classic movie, The Paper Chase irrelevant, though I think I can live with that -- I think.

Marc (MLR)

Good Commercial Faith and the City

Thank you welcoming me into this space to talk out loud about some of the aspects of commercial behavior that I have been thinking of for sometime. I'm delighted to be blogging here. In addition to talking about my article on consumer behavior, I hope to write some on other aspects of consumer decision making. But today, I want to talk about commercial virtues.

One of the troubling aspects of commercial dealings today is the focus on ethics. Truthfully, I despise the topic (perhaps because I was never very good at the subject in either theological classes or law classes -- like professional responsibility for one). But the real reason I despise ethics, my own discordant academic performance in the subject aside, is I think we are often times asking the wrong questions. We assume that by ethics, we mean some form of social responsibility, but more often than not, that responsibility is defined by communities of interest, rather than greater social values. Consider the problem with UCC 1-201 and the definition of good faith. Do we really mean good faith is "honesty in fact" when we combine that with the observation of "reasonable commercial standards of fair dealing". Which takes precedence -- clearly the latter. The secured lender that tells only part of the story to his debtor (your income statement is a mere formality) has not been completely operating with "honesty in fact" though his actions may well fit within the constraint of reasonable commercial standards of fair dealing -- after all, fudging your income was hardly the act of just a few bad apples. The subjective element of good faith gives way to the relevant community that defines what good faith means.

Deirdre McCloskey in her defense of capitalism, aptly named, the Bourgeois Virtues, makes many debatable claims that Capitalism makes the world better  (many of which I will not attempt to defend). But what McCloskey does get is that commerce (and commercial law) urges the continued development of social structures for the betterment of the individual within a community that is itself working to be better. Quoting Rabbi Starks, McCloskey writes:

(many of which I will not attempt to defend). But what McCloskey does get is that commerce (and commercial law) urges the continued development of social structures for the betterment of the individual within a community that is itself working to be better. Quoting Rabbi Starks, McCloskey writes:

It is the market -- the least overtly spiritual of contexts -- that delivers a profoundly spiritual message... The free market is the best means we have yet discovered... for creating a human environment of independence, dignity and creativity.

McCloskey's message of capitalism as a movement of social ingenuity is at its core the spiritual message of hope we find in some of our best religious literature. The prophet Jeremiah admonished the Israelites in Captivity:

This is what the Lord Almighty, the God of Israel says to all those I carried into exile from Jerusalem to Babylon: 'Build houses, settle down; plant gardens, eat what they produce, Marry and have sons and daughters; find wives for your sons and give your daughters in marriage so that they too may have sons and daughters. Increase in number there do not decrease. Seek the peace and the prosperity of the city to which I have carried you into exile. Pray to the Lord for it, for if it prospers, you too will prosper.

Ralph Waldo Emerson also saw that hope comes from capitalist engagement but only wh en the mind is able to reflect upon its work. Emerson distinguishes between the Brute Economy, in which labor and strength build vast empires of material longing only (i.e. its good to spend money to relieve us of the pain of 911), with the capitalist economy which employs intellect in an analytical expansion of labor, material and wealth. What Emerson says the Capitalist lacks is the moral and spiritual wisdom of the poet - "who acts upon nature with his entire force -- with reason as well as understanding."

en the mind is able to reflect upon its work. Emerson distinguishes between the Brute Economy, in which labor and strength build vast empires of material longing only (i.e. its good to spend money to relieve us of the pain of 911), with the capitalist economy which employs intellect in an analytical expansion of labor, material and wealth. What Emerson says the Capitalist lacks is the moral and spiritual wisdom of the poet - "who acts upon nature with his entire force -- with reason as well as understanding."

The virtue of McCloskey's work is that Commerce (and capitalism) share a common goal of enhancing our social order, instilling the hope that we might reshape "the city" into an image that is not of ourselves as we currently stand, but of the selves that we might one day hope to be, both individually and collectively. And that actions should be weighed and measured against both of these standards. Whether we segregate capitalists from capitalist poets, we nonetheless, come to the same conclusion as Emerson and McCloskey -- that commerce creates the potential for humans to be good.

Which brings me back to 1-201. Do we really want good faith to be watered down by community constraints or is there a moment for reflection of the aspirational norms that commercial dealings might adhere to? I was much happier when good faith was simply "honesty in fact" without the burden of community differences, whatever that might mean -- even if the aspirational view of good faith was nearly impossible to enforce.

Marc (MLR)

Tuesday, March 17, 2009

Commercial Law Welcomes Marc L. Roark!

Commercial Law welcomes guest blogger Marc L. Roark, a visiting associate professor of law, at University of Missouri teaching torts, secured transactions and sales. Marc will join University of LaVerne next year. Marc's recent paper, Limitation of Sales Warranties as an Alternative to Intellectual Property Rights: An Empirical Analysis of iPhone Warranties' Deterrent Impact on Consumers, considers whether limitation of warranties may actually have a deterrence effect on consumers that manufacturers desire; said differently, the article weighs whether manufacturers can achieve their goals of preventing consumers from using their products in an unauthorized manner by removing warranty protections from the consumer. Marc concludes that warranties do matter to consumers and that companies could use them better to their advantage to encourage desired consumer behavior by restricting warranty access for consumers who misuse products.

Commercial Law welcomes guest blogger Marc L. Roark, a visiting associate professor of law, at University of Missouri teaching torts, secured transactions and sales. Marc will join University of LaVerne next year. Marc's recent paper, Limitation of Sales Warranties as an Alternative to Intellectual Property Rights: An Empirical Analysis of iPhone Warranties' Deterrent Impact on Consumers, considers whether limitation of warranties may actually have a deterrence effect on consumers that manufacturers desire; said differently, the article weighs whether manufacturers can achieve their goals of preventing consumers from using their products in an unauthorized manner by removing warranty protections from the consumer. Marc concludes that warranties do matter to consumers and that companies could use them better to their advantage to encourage desired consumer behavior by restricting warranty access for consumers who misuse products.Welcome Marc!

In Defense of the Debit Card

I have found two super-fantastic uses for the debit card, and thus I must beg to differ with Jason that the payment device is all evil. They are:

1. Cash back at the merchant: You can use this (add on cash to your store purchase) to circumvent the nasty fees that the banks charge for simply withdrawing at a non-proprietary ATM. I survived a whole semester in South Bend, Indiana a few years ago without paying any fees using this debit card function, which with my bank is free. I would bet sooner or later this loophole will be closed. In the meantime I find it sweet to be cleverly manipulating my knowledge of the payment system to deprive my bank of $1.50 in fee revenue, which makes cash-back transactions even more delightful.

2. Foreign Exchange when Traveling Abroad: Any serious traveler who remembers the old days and trips to the American Express office abroad can tell you that this is the most amazing thing: Local currency is available with any Cirrus or Maestro-branded ATM with just a swipe of the debit card. True, you have to pay a fee, but generally it is no worse than those fees (and the bad exchange rates) for USD or traveler's checks. I have used ATMs from Kathmandu to Kunming, Prague to Perth, and each time I get local currency I swear it is the best payment systems invention in the last 50 years. My only advice is that before you leave, check the exchange rate and find out the local currency equivalent of the dollar amount you want to withdraw. That saves some jet-lagged confusion at arrival at the destination, trying to figure out exactly how much in local currency you should withdraw.

So, in every evil there is some good.

Sunday, March 15, 2009

"The best and the brightest"

A more politically foolish use of 0.1 percent of available cash can scarcely be imagined.

AIG chairman Edward G. Liddy's defense of these bonuses may be even more outlandish:

Raw intelligence is vastly overrated; elite educational credentials, even more so. But eclipsing these exercises in overpaying is the longstanding assumption that the very best talent in our society responds, in strictly Pavlovian fashion, to overwhelming sums of cash.We cannot attract and retain the best and the brightest talent to lead and staff the A.I.G. businesses — which are now being operated principally on behalf of American taxpayers — if employees believe their compensation is subject to continued and arbitrary adjustment by the U.S. Treasury.

And even if you disagree with everything I've written so far, surely you would endorse this recommendation: It is time to retire the phrase, the best and the brightest, in all senses except the ironic, even sarcastic, sense in which that phrase was originally intended.

The Best and the Brightest was the title of a 1972 exposé by David Halberstam of foreign policy miscalculations by the Kennedy and Johnson administrations. For much of the next two decades, American geopolitics, crafted by none less than "the best and the brightest," wreaked havoc throughout Indochina:

It will take years, decades, perhaps lifetimes to shake American business culture of the fallacy that outrageous salaries are what valuable talent truly demands and deserves. In the meanwhile, I'll settle for a split second of humility regarding the true origins of the best and the brightest.

Saturday, March 14, 2009

Madoff's Guilty Plea

"Here was a man with all the duties of seeking large money. He concocted a scheme which, on his counsel's admission, did defraud men and women. It will not do to have the world understand that such a scheme as that can be carried out ... without receiving substantial punishment."This statement could have been made at the hearing for Bernard Madoff this week. It wasn't. This quotation is attributable to Judge Clarence Hale, who made the statement before sentencing Charles Ponzi back in 1920. Ponzi never seemed to "get it" passing a note to reporters as he was led to prison stating: "Sic transit gloria mundi," or "Thus passes worldly glory." In an interview shortly before his death Ponzi apparently still had little remorse for his deeds, commenting:

"Even if they never got anything for it, it was cheap at that price.So, will Madoff get it? Madoff did say that he was "sorry" for directing the large Ponzi scheme. The sentence as it stands now is 150 years. But has he really confessed to all the wrong-doing? Even with Madoff's guilty plea, much uncertainty exists about whether Madoff really acted alone in this scheme. Moreover, the $70 million that Ruth Madoff claims as separate assets in her name is staggering. One must wonder how sorry Madoff really is if his family retains assets while the clients will recover little.

Without malice aforethought I had given them the best show that was ever staged in their territory since the landing of the Pilgrims! It was easily worth fifteen million bucks to watch me put the thing over."

Bloomberg's coverage of the guilty plea:

Evil Debit Cards and Unemployed Victims

Rarely would a story about payment devices make the marquee on CNN.com, but this story has moved from the money section to the front page . . . presumably because it's so outrageous. Some states are apparently foisting upon their unemployed citizens the fee-ridden abuse of debit cards. Want your money faster (don't we all?!), accept benefits on a pre-loaded debit card--sounds attractive. I doubt the states tell their UI benefit applicants about the dark underbelly of this device. Fee revenue is now the center of the card payment world. States allowing banks to impose these fees (sub silentio) on their hapless unemployed citizens is almost as bad as Bobby Jindal rejecting an increase in UI benefits for Louisiana citizens from the feds!

Rarely would a story about payment devices make the marquee on CNN.com, but this story has moved from the money section to the front page . . . presumably because it's so outrageous. Some states are apparently foisting upon their unemployed citizens the fee-ridden abuse of debit cards. Want your money faster (don't we all?!), accept benefits on a pre-loaded debit card--sounds attractive. I doubt the states tell their UI benefit applicants about the dark underbelly of this device. Fee revenue is now the center of the card payment world. States allowing banks to impose these fees (sub silentio) on their hapless unemployed citizens is almost as bad as Bobby Jindal rejecting an increase in UI benefits for Louisiana citizens from the feds!A bit of good news: for the first time, my poll of my Payment Systems class revealed that fewer people use debit cards rather than credit cards, and those who do have a good explanation--banks require at least 6 debits per month to waive the account maintenance fee for their "free" checking accounts. Death to debit cards and the crappy EFTA and Reg E consumer non-protection regime!

Friday, March 13, 2009

Larry Summers Remarks at the Brookings Institution

The text of Summer's speech can be found here.

Thursday, March 12, 2009

Great Video: "The Crisis of Credit Visualized"

Wednesday, March 11, 2009

If Peter Piper picked a peck of pickled peppers . . .

Well maybe this post is not about Peter Piper from the old Mother Goose nursery rhyme, but it is about peppers. Co-blogger Robyn Meadows and I just finished the Sales Survey for the ABA's Business Lawyer that will be out in August 2009. And, it contains a wonderful case about, of course, peppers. The case, Florists’ Mutual Insurance Co. v. Lewis Taylor Farms, Inc., 2008 U.S. Dist. Lexis 24445 (M.D. Ga. 2008), raises classic issues about the scope of Article 2.

Well maybe this post is not about Peter Piper from the old Mother Goose nursery rhyme, but it is about peppers. Co-blogger Robyn Meadows and I just finished the Sales Survey for the ABA's Business Lawyer that will be out in August 2009. And, it contains a wonderful case about, of course, peppers. The case, Florists’ Mutual Insurance Co. v. Lewis Taylor Farms, Inc., 2008 U.S. Dist. Lexis 24445 (M.D. Ga. 2008), raises classic issues about the scope of Article 2.Lewis Taylor Farms, Inc. (LTF) is a “greenhouse” that grows seeds (some of which are provided by farmers) to seedling plants and then sells the seedlings to farmers. LTF contracted with DL&B Enterprises, Inc. (DL&B) for some pepper plants for the fall. DL&B supplied some of the seeds for one variety of pepper and LTF supplied the seeds for two other pepper varieties. The contract required DL&B to pay LTF per transplant seedling with the cost per seedling being higher for the pepper varieties that LTF provided both seeds and growing to reflect the cost of the seeds. Although the LTF invoice did not itemize the cost of the seeds separately from the cost of raising the seed to transplant, the cost of the seeds themselves was less than 30% of the contract price.

After the DL&B received diseased seedlings from LTF, DL&B filed suit claiming breach of the warranty of merchantability. LTF moved for summary judgment, asking the court to rule that Article 2's warranties did not apply. The trial court used the “predominant” purpose test to hold that where DL&B provided most of the seeds, the cost of the seeds and the services were divisible even though not segregated in the invoice and the context indicated that DL&B emphasized the growing of the plants in conversations, the contract was one predominantly for services, not goods. Therefore, common law outlined the scope of damages.

Overall, this case seems correct, perhaps for reasons peculiar to the industry or at least the arrangements here. I have my doubts, though, about what DL&B really thought they were getting. That is, what really was the purpose of the contract? Thinking about my own purchases of pepper plants for my summer gardens, how do you really divide the growing from the product when it comes to vegetables? A fun case for sure, which I will be sure to pitch to my students the next time I teach sales.

Tuesday, March 10, 2009

Declines in university applications?

Bloomberg reported this week that applications are down this year at 7 of 8 top liberal arts colleges, some colleges down as much as 20%. Only Wellesley College was up, about 2%. What about law schools? Early reports are that law school applications are flat overall, but some schools are actually reporting increases. For instance University of Pennsylvania Law School is reporting an almost record increases in applications of 6%.

Bloomberg reported this week that applications are down this year at 7 of 8 top liberal arts colleges, some colleges down as much as 20%. Only Wellesley College was up, about 2%. What about law schools? Early reports are that law school applications are flat overall, but some schools are actually reporting increases. For instance University of Pennsylvania Law School is reporting an almost record increases in applications of 6%.So, what will happen to law school applications and enrollments by fall 2009? Normally we might expect more people to go to law school during hard economic times. But the current economic woes are pretty unprecedented. At the undergraduate level, it seems that private schools with the highest tuition are being hit the hardest in terms of application declines this year. Moreover, students looking for bargains may attend more state schools and make fewer applications. After all, law school is hardly an inexpensive endeavor. For instance, University of Pennsylvania at $41,960 for tuition is not exactly a bargain.

The high cost of law school, general economic uncertainty and the difficulty of getting loans would seem to favor some of the state schools that are bargain oriented. Early application numbers tell a mixed story. The good news is that law schools so far don't seem to be experiencing the deep declines present at the liberal arts colleges. The big problems at law schools may not be less applications, but rather lower budgets due to declining endowments and support from state revenues. At least at this point, these latter problems may have the greatest impact on law school education going forward.

What news for law schools going forward? Warren Buffet remarked recently that the economy “has fallen off a cliff.” The World Bank expects the world economy to contract in 2009. The market's pattern recently can best be described simply as one of uncertainty. The uncertainty/volatility in the markets will continue to affect the budgets available at law schools for some time to come. While this might seem grim in terms of university budgets, the impact may turn out to be harsh but manageable so long as law school applications remain somewhat stable. Like Americans generally, the law schools may simply find themselves tightening their belts to ride out lean budgetary times. As Franklin D. Roosevelt remarked:

When you come to the end of your rope, tie a knot and hang on.

Probably good advice for deans trying to balance the law school budget.

Sunday, March 8, 2009

Quality Woodworks' Embezzlement

Annette Yeomans, chief financial officer for California-based Quality Woodworks, Inc. was recently arrested in a classic case of embezzlement of $9.9 million of company funds, causing the company to lay-off workers and restructure operations. The scheme apparently lasted more than seven years and Yeomans used more than $6 million for gambling and other funds for clothing, shoes, home improvements and the like. Yeomans would charge up to $25,000 on her company credit card each week and then issue a company check the next week to pay off the balance.

Annette Yeomans, chief financial officer for California-based Quality Woodworks, Inc. was recently arrested in a classic case of embezzlement of $9.9 million of company funds, causing the company to lay-off workers and restructure operations. The scheme apparently lasted more than seven years and Yeomans used more than $6 million for gambling and other funds for clothing, shoes, home improvements and the like. Yeomans would charge up to $25,000 on her company credit card each week and then issue a company check the next week to pay off the balance.Monday, March 2, 2009

When Small Clerical Errors Explode Into Big Problems

Photo by chrishusein

Photo by chrishuseinTwo recent big stories may mean greater interest for the types of classes that we here on the Commercial Law blog teach. First came the spectacular UCC-3 filing error involving bank creditors of the law firm Heller Ehrman ("Oh, did I say 'termination,' I meant 'continuation!'") and the very serious consequences that this "clerical" error caused when the debtor went into bankruptcy. Now we have more press on an older and more serious problem. The New York Times this weekend reported on the lax assignment protocol followed (or rather, not followed) in the transfer of hundreds and thousands of mortgage notes into securitization pools. When the rare but brave judge (often in bankruptcy court) asks the foreclosing bank for proof of its ownership of a transferred/negotiated note, this proof is often unavailable--very good news for defaulting homeowner-debtors (as consumer advocates around the country are now informing their colleagues at CLE meetings), very bad news for banks. Perhaps lawyers-to-be will become more interested in following the nitty-gritty details of these transactions in the future to avoid spectacular losses. This interest will lead them right into our waiting hands!

Nitty-gritty details--that's what we commercial law profs are all about!